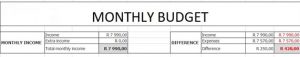

Budget Review: As a 20-something where could you be saving?

This week we review the budget of a 23-year-old male who works as a bank service consultant:

Osche’s review: “Considering that this is a 23-year-old male that is employed in a corporate, we assume that he will have some corporate benefits such as pension, medical and risk cover. Therefore this is not a pressing need at this stage, but he will need to look at it in the future to meet his long-term retirement goals.”

Housing

“This is a non-negotiable and not much can be done about these expenses. These are expected expenses for a young person.”

Transportation

“There are two inputs here: car and bus fare. The assumption is that he has a car that he uses over the weekend and the train during the week. Or that he uses his car to get to the train station. This can also be regarded as a non-negotiable as you need to get to work.

“However, I notice that there is no insurance on the car which is vital. I have budgeted an amount of R200 per month for car insurance. If you are in an accident you could potentially be liable for damage to the other car, which could set you back thousands!”

Food

“His expenses for dining out is 800 per month. This is more than 10% of his net income and is way too high.

“The suggestion here is that he cooks more at home and reduces the number of times he goes out. Maybe he can consider packing his own lunch for work as opposed to using a canteen or take-aways. I have added R200 per month to the groceries bill for this purpose.

“The assumption is that the ‘other’ is the rest of his groceries for the month.”

Personal care

“Until he has paid off his accounts, I suggest that he does not buy new clothing. He should also cut his hair every second month or find a cheaper barber. His budget is now R100 per month.”

Club fees

“It is assumed that this is a gym membership or fitness focussed such as a rugby or soccer club. Considering that health is important, we will leave this alone on the understanding that he uses it. If he has not been to gym or the club at least eight times in the last month, he should consider cancelling it and applying this to his debt.”

Entertainment

“There is an amount of R210 budgeted for this. I would suggest that this is dropped down a bit to R150 until he is out of debt.”

Loans

“There are two loans with a total repayment of R2660 which is approximately 33% of his net income. This is better than most South Africans, but it is still not good to use debt to sustain your lifestyle. It would be best to pay this off as soon as possible. Once he has paid off his credit card, he needs to apply this full instalment to the other loan that he has and pay his debt off. Then he can direct that to long-term savings and investing, such as saving for the purchase of his first home.”

By effecting these changes there is a surplus of about R840 per month.

This can be applied as follows:

- R240 for an emergency fund, so that if there is an emergency he does not need to rely on debt.

- R300 towards his credit card debt, in addition to what he is paying off now.

- This leaves about R250 per month for the odd unexpected expenses which might arrive. If this is not used, add to credit card debt and emergency fund.

The key here is to stay disciplined and stick to the course.

MoneyShop